Artemis to Acquire Blackwater Project From New Gold

June 9, 2020

AT 9.5 MILLION M&I OUNCES*, BLACKWATER IS ONE OF THE LARGEST OPEN-PIT GOLD DEPOSITS IN CANADA

ONE OF THE WORLD’S LARGEST EA APPROVED GOLD DEVELOPMENT PROJECTS

All amounts are in Canadian Dollars unless otherwise noted

ARTEMIS GOLD INC. (“Artemis” or the “Company”) is pleased to announce the signing of an Asset Purchase Agreement (the “Agreement”) with New Gold Inc. (“New Gold”) to acquire the Blackwater Gold Project (“Blackwater” or the “Project”) in central British Columbia ( the “Acquisition”).

Key Acquisition Terms:

- Initial cash payment of $140 million (the “Initial Payment”) at closing of the Acquisition (“Closing”);

- Issuance to New Gold of Artemis common shares (the “Consideration Shares”) equal to the lesser of (a) the number of Consideration Shares having an aggregate deemed price of $20 million and (b) 9.9% of the issued and outstanding Artemis common shares as at Closing;

- Second cash payment of $70 million, less approximately $20 million (being the aggregate issuance price of the Consideration Shares) 12 months after Closing;

- An 8% stream at 35% of US$ spot gold price reducing to 4% after 279,908 ounces delivered;

- The Initial Payment is backstopped by our major shareholder Ryan Beedie;

- An equity financing is planned to finance some or all of the Initial Payment over the next several weeks, with Board and Management who currently hold approximately 45% of the shares of the Company, planning to commit to approximately half of that equity financing (up to a maximum of $70 million), subject to shareholder approval;

Transaction Highlights

- The addition of a world class asset with Federal and Provincial EA approvals in place, allowing for the possibility of near-term construction;

- Significant Mineral Resource of 9.5 million ounces, Measured and Indicated*:

- Robust economics based on the 2014 Feasibility Study. Artemis believes that today’s long-term consensus pricing and current spot prices will contribute to driving economic potential.

* Refer to Mineral Resource table on page 11.

Artemis Strategy to Development

Artemis will be targeting improved economics and financeability against the 2014 Feasibility Study (defined below) based on Artemis due diligence including the following:

- Reducing initial capital expenditures by staging the mine throughput ramp-up while remaining committed to the full-scale project;

- Targeting lower initial start-up capital expenditure with 1-2 subsequent expansion stages to the 20 mtpa Feasibility Study case, estimated to be funded from future operating cashflows;

- Our MIK (Multiple Indicator Kriging) approach to resource modelling may further optimize tonnes and grades within the pit;

- The 2014 Feasibility Study resource modelling identifies a large higher-grade zone of mineralization near-surface within the southern half of the pit design which will be the focus of further mine planning analysis by Artemis;

- The application of our grade control drilling approach and modeling methodology may optimize mine scheduling, grade cut-off strategies, and better define ore and waste boundaries within the pit; and

- Methodical de-risking of key project risks

While the Company considers the 2014 Feasibility Study to be current, it plans to prepare an updated Pre-Feasibility Study based on our revised approach to developing the Project over the next three months and will file the technical report within 180 days of this announcement of mineral resources and mineral reserves.

Commitment to Indigenous Groups

Artemis respects the rights and interests of Indigenous groups who may be impacted by the Project and intends to fully honour New Gold’s existing agreements, including the Participation Agreement with the Lhoosk’uz Dené Nation and the Ulkatcho First Nation. New Gold has engaged extensively with other Indigenous groups who may be impacted by the Project, including Nadleh Whut’en First Nation, Saik’uz First Nation, Stellat’en First Nation and Nazko First Nation, and Artemis is committed to continuing that engagement. Establishing a working relationship built on trust, respect and integrity with these Indigenous groups will be a priority of the Company.

Steven Dean, Chairman and CEO of Artemis noted: “The proposed acquisition of Blackwater is the first meaningful step in our strategy to develop a first tier gold deposit in one of the world’s premier low risk mining jurisdictions. As with our team’s previous success in developing the Moose River Consolidated Mine in Nova Scotia for Atlantic Gold, our focus will be the methodical de-risking of the project development to enhance NPV, optimize IRR and minimise equity dilution to shareholders.

Furthermore, the additional attribute of having an environmental assessment approval in hand significantly curtails the timeline to construction and ultimate production. This value cannot be underestimated in today’s world. We look forward to completing the Acquisition in due course, working with the various key stakeholders to continue to advance Blackwater through the development stage and into operation.”

Artemis Project Development De-Risking Approach

In addition to the technical and financially based optimisation development strategy outlined below, management plans to pursue its proven de-risking and structuring strategies in developing the Project:

- Securing a fixed price construction and performance contract for the processing plant and associated infrastructure;

- Securing project debt finance for the majority of the initial Project capital expenditures;

- Considering a small amount of gold price hedging to reduce revenue pricing risk and optimize financing terms;

- Considering contracting ownership of key infrastructure, including the power line, to third parties;

- Undertaking a high-density grade control drilling program on a portion of the first year’s mill tonnage prior to commencement of construction to achieve higher confidence for tonnes and grade, and advance reconciliation to the global resource model

While managing and reducing development risk, these strategies are designed to:

- Improve competitiveness of project debt financing

- Further enhance NPV of the Project

- Optimize the Internal Rate of Return of the Project

- Minimize equity dilution to shareholders

- Maximize returns to shareholders

About Blackwater

All technical information on Blackwater is based on a Feasibility Study technical report entitled “Blackwater Gold Project, British Columbia, NI 43-101 Technical Report on Feasibility Study” with an effective date of January 14, 2014, filed on SEDAR by New Gold on January 22, 2014 (the “Feasibility Study”). To the best of Artemis’ knowledge, information, and belief, the Feasibility Study is considered current pursuant to NI 43-101 and there is no new material scientific or technical information that would make the disclosure of the mineral resources, mineral reserves or results of the Feasibility Study inaccurate or misleading.

Selected 2014 Feasibility Study Parameters and Outputs

- Life-of-mine gold and silver production of 7 million ounces and 30 million ounces, respectively

- First nine years – average annual gold production of 485,000 ounces at total cash costs of US $555 per ounce and all-in sustaining costs of US $685 per ounce**

- Conventional truck and shovel open pit mine with 60,000 tonne per day whole ore leach processing plant at full capacity

- 17-year mine life with direct processing for first 14 years and processing of stockpile thereafter

- Life-of-mine operational strip ratio of 1.88 to 1.00

** Refer to Non-GAAP Measure Disclosure on page 8.

- Base case economics in 2014 Feasibility Study – at US $1,300 per ounce gold, US $22 per ounce silver and a 0.95 US$/C$ foreign exchange rate, or CAD$1,368/oz equivalent (compared to current consensus of over CAD $1,900/oz. equivalent and current spot of approximately CAD $2,300/oz. equivalent), Blackwater had a pre-tax 5% NPV of $1,044 million, an IRR of 11.3% and a payback period of 6.2 years

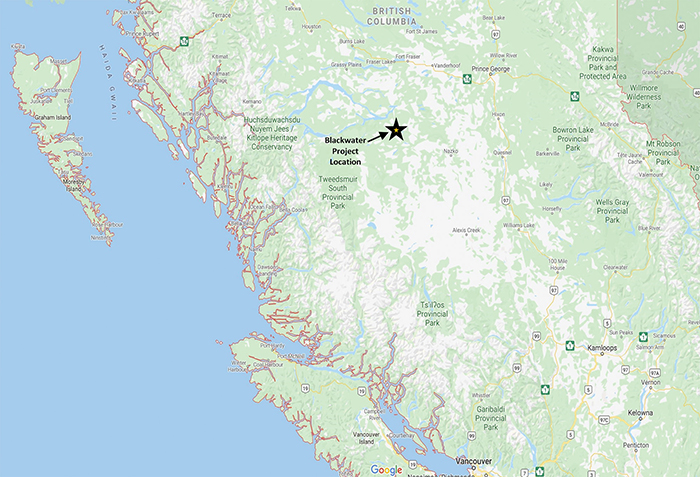

Location

The Project is located in central British Columbia, approximately 160 km southwest of Prince George and 446 km northeast of Vancouver. The Project is accessible by major highway and access road.

Artemis is acquiring New Gold’s 100% recorded interest in 328 mineral claims covering an area of 148,688 ha distributed among the Property and the Capoose, Auro, Key, Parlane and RJK claim blocks. Surface rights over the Project area are controlled by the Crown.

Figures 1 and 2 – Blackwater Property Location Maps

Environmental and Permitting

The Project received a federal Decision Statement and a provincial Environmental Assessment Certificate in June 2019, which are major milestones in respect of de-risking the Project to ultimate permitting and construction.

Additional permits and authorizations are required from both the provincial and federal governments prior to the mine proceeding to the construction and operation phase, including provincial permits under the Mines Act and the Environmental Management Act for discharge, and federal authorizations under the Fisheries Act and Explosives Act. Management will be working closely with New Gold to transition efforts to date to Artemis to ensure management are able to progress the permitting timeline.

Transaction Summary

Pursuant to the Agreement, Artemis will acquire all of New Gold’s property, assets and rights related to the Project. The Acquisition will be completed through BW Gold Ltd. (“BW”), a wholly owned subsidiary of Artemis. Following the Closing, BW will hold a 100% interest in the Project.

Consideration for the Acquisition will be comprised of (i) the Initial Payment of $140 million at Closing, (ii) approximately $20 million in Consideration Shares (described below), (iii) a cash payment one year following Closing of $70 million less the aggregate deemed issue price (as described below) of the Consideration Shares, and (iv) a secured gold stream participation in favor of New Gold as described below. New Gold will also have a first ranking security interest over the Blackwater Project until the Second Payment is made.

Artemis expects to fund the Initial Payment through an equity financing to be completed prior to Closing (the “Financing”). Although management is confident it will be successful in funding the Initial Payment through the Financing, in the event of a shortfall, Mr. Ryan Beedie, who is also expected to participate in the Financing, has provided a commitment letter to fund the Initial Payment to the extent necessary. Artemis will announce further details regarding the Financing once available.

The deemed issue price of the Consideration Shares will be the lowest price at which common shares of Artemis are sold pursuant to the Financing. The number of Consideration Shares to be issued to New Gold will be the lesser of (i) the number of Artemis common shares having an aggregate deemed issue price of C$20 million, and (ii) 9.9% of the issued and outstanding Artemis common shares as at Closing.

At Closing, Artemis will enter into a gold stream agreement with New Gold (the “Stream Agreement”) whereby New Gold will purchase 8.0% of the refined gold produced from the Blackwater Project. Once 279,908 ounces of refined gold have been delivered to New Gold, the gold stream will reduce to 4.0%. New Gold will make payments for the gold purchased equal to 35% of the US dollar gold price quoted by the London Bullion Market Association two days prior to delivery. In the event that commercial production at Blackwater is not achieved by the 7th, 8th, or 9th anniversary of closing of the Acquisition, New Gold will be entitled to receive additional cash payments of $28 million on each of those dates.

Closing of the Acquisition is subject to the satisfaction of customary closing conditions for a transaction of this nature, including obtaining certain regulatory approvals and the approval of the TSX Venture Exchange. The Financing will be subject to disinterested shareholder approval by the shareholders of Artemis due to the participation by insiders in the Financing. Artemis will announce further details regarding the shareholder meeting to be held to consider the Financing once available. The Acquisition is expected to close in 60 to 90 days, or such other date as the parties may agree. Furthermore, as required under applicable securities laws, the Company will file an updated technical report on the Project, in accordance with NI 43-101, within 180 days of this press release.

Agreements with Indigenous Groups

In 2019, New Gold executed a Participation Agreement with the Lhoosk’uz Dené Nation and the Ulkatcho First Nation, the two Indigenous groups whose traditional territories overlap the Project’s mine site. New Gold has continued to engage with other Indigenous groups who may be affected by the Project, including the Nadleh Whut’en First Nation, Saik’uz First Nation, Stellat’en First Nation and Nazko First Nation. Engagement and negotiations with these groups will be a priority for the Company as management progresses towards Closing and through to final permitting of the Project.

Next Steps

In the coming months, the Company will be focused on the following activities:

- Completion of the Financing;

- Completion of all other conditions required to achieve the Closing of the Acquisition;

- Engagement and transition initiatives with respect to further permitting requirements;

- Establishing relationships and continuing engagement and negotiations with Indigenous groups who may be affected by the Project; and

- Completion of an updated Pre-Feasibility Study over the next three months.

Updates will be provided in due course.

ARTEMIS GOLD INC.

On behalf of the Board of Directors

“Steven Dean”

Chairman and Chief Executive Officer

For further information: Chris Batalha, CFO and Corporate Secretary, +1 (604) 558-1107.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains certain "forward looking statements" and certain "forward-looking information" as defined under applicable Canadian and U.S. securities laws (together, “forward-looking statements”). Forward-looking statements can generally be identified by the use of forward-looking terminology such as "may", "will", "expect", "intend", "estimate", "anticipate", "believe", "continue", "plans", "potential" or similar terminology. Forward-looking statements in this news release include, but are not limited to, statements and information related to the Closing and the ability of the parties to satisfy the conditions and close the Acquisition; approval of the Financing by the disinterested shareholders of the Company; the terms of the Financing and ability of the Company to complete the Financing; the merits of the Project; the Company’s plans and objectives with respect to the Project and the timing related thereto, including with respect to permitting, construction, improved economics and financeability, and de-risking development risks; the Company’s plans to file a Pre-Feasibility Study for the Project over the next three months; and other statements regarding future plans, expectations, guidance, projections, objectives, estimates and forecasts, as well as statements as to management's expectations with respect to such matters.

Forward-looking statements and information are not historical facts and are made as of the date of this news release.,. These forward-looking statements involve numerous risks and uncertainties and actual results may vary. Important factors that may cause actual results to vary include without limitation, risks related to the ability of the parties to satisfy the conditions of the Acquisition and close the Acquisition; the ability of the Company to settle the terms of the Financing, obtain disinterested shareholder approval of the Financing, and complete the Financing; the ability of the Company to accomplish its plans and objectives with respect to the Project within the expected timing or at all, including the ability of the Company to improve the economics and financeability and de-risk the Project; the ability of the Company to file a Pre-Feasibility Study for the Project over the next three months; the timing and receipt of certain approvals, changes in commodity and power prices, changes in interest and currency exchange rates, risks inherent in exploration estimates and results, timing and success, inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral reserves and resources), changes in development or mining plans due to changes in logistical, technical or other factors, unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications, cost escalation, unavailability of materials, equipment and third party contractors, delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), political risk, social unrest, and changes in general economic conditions or conditions in the financial markets. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, the assumptions that: (1) the parties will be able to complete the Acquisition and Financing on the expected timing; (2) the Company will be able to accomplish its plans and objectives with respect to the Project and Pre-Feasibility Study within the expected timing; (3) market fundamentals will result in sustained mineral demand and prices; (4) the receipt of any necessary approvals and consents in connection with the development of any properties; (5) the availability of financing on suitable terms for the development, construction and continued operation of any mineral properties; and (6) sustained commodity prices such that any properties put into operation remain economically viable. The actual results or performance by the Company could differ materially from those expressed in, or implied by, any forward-looking statements relating to those matters. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the Acquisition, the Financing, results of operations or financial condition of the Company. Except as required by law, the Company is under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Non-GAAP Measures

TOTAL CASH COSTS: “Total cash costs” per ounce figures are non-GAAP measures which are calculated in accordance with a standard developed by The Gold Institute, which was a worldwide association of suppliers of gold and gold products and included leading North American gold producers. The Gold Institute ceased operations in 2002, but the standard is widely accepted as the standard of reporting cash costs of production in North America. Adoption of the standard is voluntary and the cost measures presented may not be comparable to other similarly titled measures of other companies. New Gold reports total cash costs on a sales basis. Total cash costs include mine site operating costs such as mining, processing, administration, royalties and production taxes, but are exclusive of amortization, reclamation, capital and exploration costs. Total cash costs are reduced by any by-product revenue and is then divided by ounces sold to arrive at the total by-product cash cost of sales. The measure, along with sales, is considered to be a key indicator of a company’s ability to generate operating earnings and cash flow from its mining operations. This data is furnished to provide additional information and is a non-IFRS measure. Total cash costs presented do not have a standardized meaning under IFRS and may not be comparable to similar measures presented by other mining companies. It should not be considered in isolation as a substitute for measures of performance prepared in accordance with IFRS and is not necessarily indicative of operating costs presented under IFRS.

ALL-IN SUSTAINING COSTS: Consistent with the guidance announced earlier in 2013 from the World Gold Council, an association of various gold mining companies from around the world of which New Gold is a member, New Gold defines “all-in sustaining costs” as the sum of total cash costs, sustaining capital expenditures, corporate general & administrative costs, capitalized and expensed exploration that is sustaining in nature and environmental reclamation costs. New Gold believes this non-GAAP measure provides further transparency into costs associated with producing gold and will assist analysts, investors and other stakeholders of the company in assessing its operating performance, its ability to generate free cash flow from current operations and its overall value. All-in sustaining costs constitute a non-GAAP measure and are intended to provide additional information only and do not have any standardized meaning under IFRS. They should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Other companies may calculate these measures differently.

Scientific and Technical Disclosure

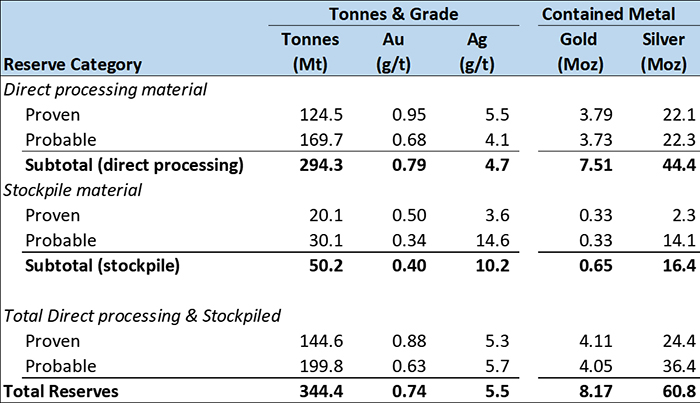

Mineral Reserve Estimate (Feasibility Study)

Mineral Reserves are classified in accordance with the 2010 CIM Definition Standards for Mineral Resources and Mineral Reserves. The Qualified Person for the estimate is Mr. Jay Horton, P.Eng., of Norwest Corporation. Mineral Reserves have an effective date of December 2, 2013.

Mineral Reserves are summarized in the table below.

Table 1 – Blackwater Mineral Reserve Statement

Notes to Accompany the Mineral Reserves Table:

- Mineral Reserves are reported within an open pit design based on metal prices of US$1,300/oz gold, US$22/oz silver, with variable recoveries by grade and ore type averaging 86.6% for gold and 49.1% for silver.

- Contained metal calculated on the basis of Tonnes * Grade / 31.10348 grams per troy ounce.

- Mineral Reserves that are classified as amenable to direct processing are defined as mineralization above a lower cut-off grade that varies by year between 0.26 g/t and 0.38 g/t AuEq and represents ore that is to be mined and processed directly.

- Mineral Reserves noted as stockpiled material consist of ore tonnage above a 0.32 g/t AuEq cut-off grade that is mined and stockpiled before being sent to the mill. This stockpiled tonnage includes ore mined before mill start-up, lower grade ore mined during preproduction and commercial production, and ore tonnage misclassified or misallocated during the mining process. No stockpiles currently exist at site.

- The gold-equivalent value used for cut-off grades only is based on US$1,400/oz gold, US$28/oz silver, and average metallurgical recoveries of 88.0% gold and 64.0% silver for oxide mineralization, 85.0% gold and 58.0% silver for transitional oxide / sulphide mineralization, and 85.0% gold and 44.0% silver for sulphide mineralization.

- Cut-off grade values are based on a gold price of US$1,300/oz. The cut-off grade calculation includes the following costs: minimum profit; operating cost (ore mining, hauling cost, processing, G&A); sustaining capital cost for mining, tailings storage facility and the mill; royalty and refining cost; reduced metallurgical gold recovery for stockpiled ore (79%).

- There are two primary dilution and loss scenarios. The first scenario sees a surplus of ore being mined and being sent to both the mill and the low-grade stockpile. In the second scenario, all ore mined is sent to the mill with no surplus sent to the low-grade stockpile. Average dilution for periods where both the mill and the stockpile are fed is 5% at a grade of 0.16 g/t Au and 3.19 g/t Ag. For periods where all ore is sent to the mill directly, dilution is 4% at a grade of 0.12 g/t Au and 2.90 g/t Ag.

- Tonnages grades and metal content are rounded.

- Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content.

- Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces.

The following factors may affect the mineral reserve estimates:

- Gold and silver prices

- US dollar exchange rates

- Geotechnical assumptions

- Ability of the mining operation to meet the annual production rate

- Mill recoveries

- Capital and operating cost estimates.

- Ability to meet and maintain permitting and environmental license conditions, and the ability to maintain the social license to operate.

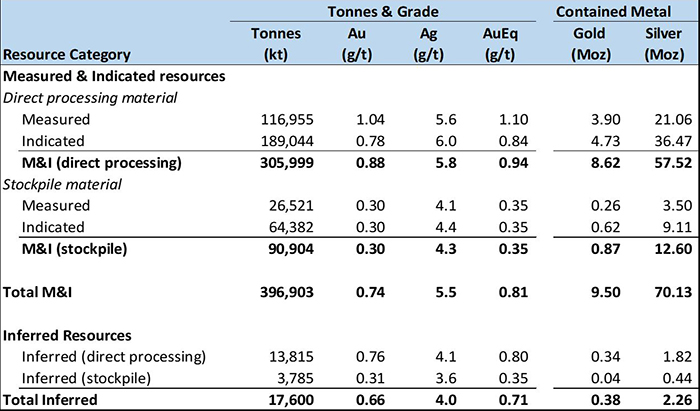

Mineral Resource Estimate (Feasibility Study)

The Qualified Person for the Mineral Resource estimate is Ronald G. Simpson, P. Geo., of Geosim Services Inc. Mineral Resources have an effective date of March 31, 2013.

Mineral Resources are classified in accordance with the 2010 CIM Definition Standards for Mineral Resources and Mineral Reserves. Mineral Resources are reported inclusive of Mineral Reserves and do not include dilution. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The Mineral Resource estimate segregates the portion of mineralized material that should be processed directly versus that which the company would likely stockpile and process toward the end of the mine life of the Project. In order to complete this segregation, New Gold elected to utilize a dual cut-off strategy, whereby all material with an AuEq cut-off of greater than 0.4 g/t AuEq is considered for direct processing, while all material with an AuEq grade of between 0.3 and 0.4 g/t AuEq is planned to be stockpiled. The Mineral Resource estimate, inclusive of the Mineral Reserves reported in this news release, is presented below.

Table 2 – Blackwater Mineral Resource Statement

Notes to accompany Mineral Resource Table:

- Mineral Resources are reported inclusive of Mineral Reserves.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are reported within a conceptual open pit shell based on metal prices of US$1,400/oz gold, US$28/oz silver, and average metallurgical recoveries of 88.0% gold and 64.0% silver for oxide mineralization, 85.0% gold and 58.0% silver for transitional oxide / sulphide mineralization, and 85.0% gold and 44.0% silver for sulphide mineralization. The pit shell also considers a mining cost of $1.64/t for mineralized material, waste mining cost of $1.94/t; ore processing cost of $6.85/t; sustaining capital for the mill of $0.18/t; G&A cost of $1.25/tonne; allocation for the tailings facility costs of $0.60/t; royalties at 1.5% of revenue; refining costs of 0.1% of Revenue, and pit slopes that range from 23 to 43º.

- Total contained metal calculated on the basis of Tonnes * Grade / 31.10348 grams per troy ounce.

- Gold-equivalent grade estimate based on US$1,400/oz gold, US$28.00/oz silver, and differential metallurgical recoveries (refer to footnote 3).

- Direct processing material is defined as mineralization above a 0.4 g/t AuEq cut-off that is likely to be mined and processed directly.

- Stockpile material defined as mineralization above a 0.3 g/t AuEq and below a 0.4 g/t AuEq cut-off that is suitable for stockpiling and future processing based on average metallurgical recoveries of 79.0% gold and 37.0% silver. The 0.3 g/t AuEq lower cut-off grade is considered adequate to cover mining, processing, and additional handling costs.

- Tonnages are rounded to the nearest 1,000 tonnes, grades and metal content are rounded to two decimal places.

- Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content.

- Tonnage and grade measurements are in metric units. Contained gold and silver ounces are reported as troy ounces.

Factors which could affect the Mineral Resource estimates include:

- Interpretations of mineralization geometry and continuity of mineralization zones;

- Commodity price and exchange rate assumptions;

- Pit slope angles and other geotechnical factors;

- Assumptions used in generating the pit shell, including metal recoveries, and mining and process cost assumptions

There are no other known factors or issues that materially affect the Mineral Resource estimate other than normal risks faced by mining projects in the province in terms of environmental, permitting, taxation, socio-economic, marketing and political factors.

Marc Schulte, P. Eng., an independent consultant to the Company and a Qualified Person as defined by NI 43-101, has reviewed and is responsible for the technical information contained in this news release and has reviewed the Feasibility Study.