Artemis Announces Results From Blackwater Economic Impact Study

- 457 direct jobs created - Life of mine operations

- 825 direct jobs created during construction/expansion phases

- $13.2 billion in value added in B.C. - LIFE OF MINE

- $2.3 billion in Provincial Government Revenues – life of mine

All amounts are in Canadian Dollars unless otherwise noted

ARTEMIS GOLD INC. (TSXV: ARTG) (“Artemis” or the “Company”) is pleased to announce the results of an Economic Impact Study (the “Study”) conducted on the company’s Blackwater Gold project in Central British Columbia, Canada (“Blackwater” or the “Project”).

The Company engaged KPMG to produce the Study to be used to measure the updated economic benefits of the staged approach to the development of the Project. The Study focuses on job creation, fiscal revenues, and overall economic wealth creation for the regions within and surrounding the Project, the Province and for Canada.

The statistics produced in the Study are based on the base case scenario of the three-phased development of the Project as reported in the Company’s Pre-Feasibility Study (“PFS”) dated August 26, 2020 entitled “Blackwater Gold Project British Columbia NI 43-101 Technical Report on Pre-Feasibility Study” over a minimum 23 year mine life. The base case assumes:

- Initial development capital of $592 million to build a 5.5 million tonne per year mine (years 1-5)

- $426 million in capital costs to expand to 12 million tonnes per year (years 6-10)

- $398 million in capital costs to expand to 20 million tonnes per year (years 11-23)

The selected B.C. regions within the Study included the Bulkley-Nechako, Fraser-Fort George and Cariboo. With a total capital investment of $1.5 billion (initial and expansion capital), Blackwater would be one of the largest capital investments for the region in the last ten years.

The tables below provide a summary of the economic impact on the regions, the province and on government revenues:

Table 1: Summary of total economic impact (direct, indirect and induced) on British Columbia stemming from construction and operating activities of the Blackwater Mining Project1

Over the LOM, in M$ and person-years, total and annual average

| British Columbia | Total | Annual Average2 |

| Overall construction activities would last 5 years (2 years initial phase followed by 2 expansion phases (15-18 months each) Operating phase would last for 23 years |

||

| Value added (in M$) | 13,234 | - |

| Construction2 | 810 | 162 (over 5 years) |

| Operations | 12,424 | 540 (over 23 years) |

Note: Due to rounding, the sum of items may not add up to the total.

Source: Simulations of B.C. Stat based on data from Artemis, KPMG analysis

Table 2: Value-added and jobs stemming from the construction2 and operation of the Blackwater Project in British Columbia

| British Columbia | Direct Effects |

Indirect Effects |

Induced Effects |

Total |

|---|---|---|---|---|

| In millions of dollars | ||||

| Total value added during construction2 | 485 | 221 | 104 | 810 |

| Value added per year during operations | 419 | 100 | 21 | 540 |

| In Full Time Equivalent | ||||

| Jobs per year over 5 years of construction2 | 825 | 453 | 222 | 1,499 |

| Jobs per year during operations | 457 | 698 | 211 | 1,366 |

Note: Due to rounding, the sum of items may not add up to the total.

Source: Simulations of B.C. Stat based on data from Artemis; KPMG analysis

Table 3: Value-added and jobs stemming from the construction2 and operation of the Blackwater Project for the B.C. regions under study

| Cariboo, Bulkily-Nechako and Fraser-Fort George Reginal Districts | Direct Effects |

Indirect Effects |

Induced Effects |

Total |

|---|---|---|---|---|

| In millions of dollars | ||||

| Total value added during construction2 | 186 | 107 | 43 | 335 |

| Value added per year during operations | 419 | 38 | 7 | 464 |

| In Full Time Equivalent | ||||

| Jobs per year over 5 years of construction2 | 563 | 148 | 82 | 792 |

| Jobs per year during operations | 457 | 197 | 71 | 726 |

Source: Simulations of B.C. Stat based on data from Artemis; KPMG analysis

Table 4: Summary of total tax revenues stemming from construction and operating activities of the Blackwater Mining Project (direct, indirect and induced)

Over the LOM, total and annual average

| Government Revenues (in M$) | Total | Annual Average |

| Overall construction phase would last 5 years (2 years initial phase follow by 2 expansion phases (15-18 months each) Operating phase would last for 23 years |

||

| Municipal government revenue | 73 | - |

| Construction | 15 | 3.0 (over 5 years) |

| Operations | 58 | 2.5 (over 23 years) |

| Provincial government revenue | 2,290 | - |

| Construction | 105 | 21 (over 5 years) |

| Operations | 2,185 | 95 (over 23 years) |

| Federal government revenue | 1,513 | - |

| Construction | 110 | 22 (over 5 years) |

| Operations | 1,403 | 61 (over 23 years) |

Note: Due to rounding, the sum of items may not add up to the total. Does not include direct property taxes paid by the mine.

Source: Simulations of B.C. Stat based on data from Artemis, KPMG analysis

Steven Dean, Chairman and CEO commented “The results of the Economic Impact Study confirms what the development of the Blackwater Gold Project will deliver as a new economic engine for central British Columbia and Canada. After over seven years of the Project being diligently and respectfully advanced through the environmental assessment process and reaching agreement with the Lhoosk’uz Dené and Ulkatcho First Nations the environmental assessment was approved in 2019. Artemis continues to be committed to the responsible advancement of the Blackwater Gold project. The Blackwater Project has the potential to economically contribute at the local, provincial and federal levels for more than 25 years.”

Next Steps

The Company is focused on advancing the Project forward with the following priorities:

- Progression and achievement of final permitting required to commence construction;

- The commencement of a pre-Construction grade control drilling program;

- Negotiating and awarding of lump-sum fixed price EPC Contracts in respect of key components of construction of the Project;

- Arrangement of requisite debt and equity financing to support development activities;

- Planning for a diamond drilling exploration program to test resource extensions where the deposit remains open;

- Continuing engagement and consultation with other Indigenous groups who may be impacted by the Project;

- Continuing work on a definitive Feasibility Study based on the revised development approach with detailed engineering of the Project;

Corporate Update – Tier Graduation – Supplemental Disclosure

On October 30, 2020, the Company announced that it has been approved for graduation from Tier 2 to Tier 1 issuer status on the TSX Venture Exchange (the "TSXV") effective November 4, 2020.

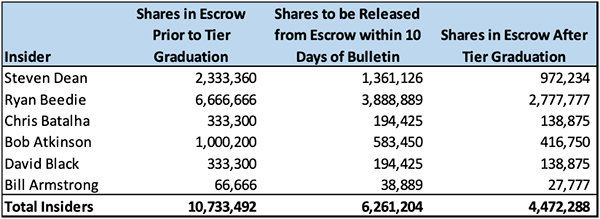

As required disclosure under TSXV Policies and the escrow agreement between the Company and Computershare Investor Services Inc. dated October 2, 2019, the below table outlines the remaining shares in escrow post graduation to Tier 1.

The remaining shares held in escrow are scheduled to be released on April 30, 2021.

ARTEMIS GOLD INC.

On behalf of the Board of Directors

“Steven Dean”

Chairman and Chief Executive Officer

+1 604 558 1107

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans”, “potential” or similar terminology. Forward-looking statements and information are not historical facts, are made as of the date of this news release, and include, but are not limited to, statements regarding the Private Placement, the proceeds and use of proceeds from the Private Placement and the closing of the Private Placement. These forward-looking statements involve numerous risks and uncertainties and actual results may vary. Important factors that may cause actual results to vary include without limitation, risks related to the Private Placement, risks related to the ability of the Company to settle documentation and close the Private Placement, and risks related to the Company’s ability to use the proceeds of the Private Placement as anticipated. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, the assumptions that: (1) the Private Placement will be completed and proceeds used as expected by management; (2) the receipt of any necessary approvals and consents; and (3) that the Company will be able to close the Private Placement on the terms set out in this news release. The actual results or performance by the Company could differ materially from those expressed in, or implied by, any forward-looking statements relating to those matters. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of the Company. Except as required by law, the Company is under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

1 Total impact includes direct, indirect and induced effects.

2 For construction, we assumed that the overall project, including initial phase and the 2 expansion phases, would take 60 months or 5 years, therefore, results may vary depending on the exact length of each phase. Also includes closure costs.